These AI stocks could surge in December as momentum builds | Colorful fool

Continued spending on AI hardware should continue to boost these chip stocks.

As December draws to a close, there are a few stocks that I think could rise by the end of the month. While the market may be somewhat weary of the artificial intelligence (AI) business, the reality is that hyperscalers will spend more than ever on AI computing power in 2026. A handful of oversized companies are benefiting from this, and some of those that have already been the biggest winners of this spending will thrive in 2026.

Three such stocks that I think could rise by the end of the year are Nvidia (NVDA +1.91%), AMD (AMD +1.49%)and Taiwanese semiconductor manufacturing (TSM +2.79%).

Image source: Getty Images.

Nvidia

Nvidia is the top performing AI fund since the start of the build in 2023. While some impressive technologies have been developed over the past few years, we’ve only scratched the surface of what generative AI is capable of. As a result, hyperscalers are planning record data center capital expenditures in 2026 after setting new spending records in 2025. Nvidia is one of the primary beneficiaries of this spending, as its graphics processing units (GPUs) provide a significant portion of the computing power that goes into these data centers.

Today’s Change

(1.91%$3.27

Current price

$174.21

Key data points

Market capitalization

4.2 T

Daily range

$171.82 -$176.14

Range 52 weeks

$86.62 -$212.19

Volume

4.8 million

Avg. flight

192 million

Gross margin

70.05%

Dividend yield

0.02%

Nvidia’s GPUs are best in class, thanks in part to the technology stack that supports them. It continues to have impressive quarter after impressive quarter, and the third quarter of its 2026 fiscal year (which ended on October 26) was no exception. Revenue was up 63% year over year and diluted earnings per share (EPS) was up 67%. Demand for Nvidia’s GPUs has been so high that CEO Jensen Huang has commented that the company is “sold out” of cloud GPUs.

AI data center construction isn’t expected to slow down anytime soon: Nvidia executives believe global data center capital spending will reach between $3 trillion and $4 trillion by 2030. Nvidia may be down a bit until 2026, but assuming expected spending happens, it should be a great stock to buy now.

AMD

AMD hasn’t had nearly as much success as Nvidia in the AI arms race. While its GPUs aren’t far behind Nvidia in performance, its supporting technology falters, specifically its control software. However, AMD has made several acquisitions and formed some partnerships that have improved its supporting products, and management believes it can turn the company’s fortunes around and make a big splash in the AI world.

Today’s Change

(1.49%$2.95

Current price

$201.06

Key data points

Market capitalization

327 billion dollars

Daily range

$200.50 -$206.36

Range 52 weeks

$76.48 -$267.08

Volume

30 million

Avg. flight

55 million

Gross margin

44.33%

Management believes the company can grow its data center business at a 60% compound annual growth rate over the next five years. That would be a massive increase over the 22% growth the segment achieved in its last reported quarter. AMD will have a long way to go to prove it can deliver growth that rivals Nvidia, but if it can do so, the stock should perform impressively.

I think the market may begin to recognize this shift in fortunes, which will cause AMD stock to rise in the final days of December.

Taiwanese semiconductor manufacturing

Both Nvidia and AMD design the chips, but neither manufactures them in-house. Instead, like many other “fabulous” chip makers, they operate multiple companies. For cutting-edge chips, that job usually falls to Taiwan Semiconductor, the world’s largest chip foundry by revenue. Taiwan Semiconductor is a genius investment because it doesn’t matter if it’s Nvidia, AMD, or some other top-of-the-line computing designer, the foundry is still in a position to benefit from their sales. For Taiwan Semi, all that really matters is that the AI hyperscalers are spending more and more.

Admittedly, his status as a neutral player in an AI lineup may limit his overall contribution. However, based on growth projections for the AI infrastructure market, I’d be surprised if Taiwan Semiconductor wasn’t the top performing stock over the next five years.

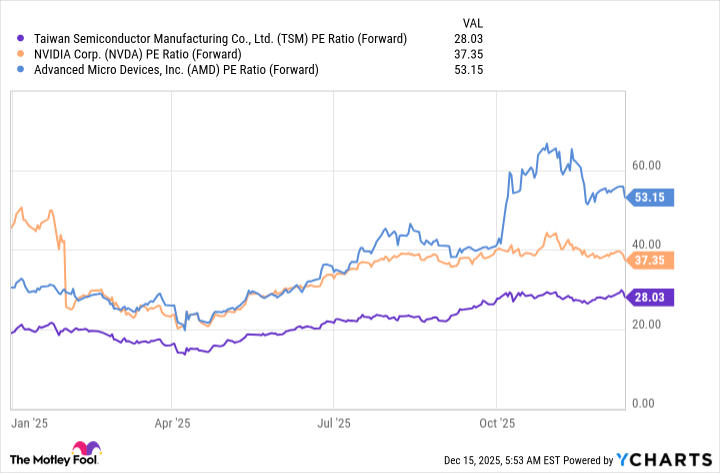

It’s also much cheaper than GPU designers, trading at 28 times expected future earnings.

TSM PE Ratio (Forward) data by YCharts.

I’m a big fan of Taiwan Semiconductor and its invaluable position in the AI space, and I believe the market can reward it heading into 2026.