Palantir CEO Alex Karp’s Rant About Short-Sellers Completely Misses the Point

Palantir’s billionaire boss appears to be playing a misplaced blame game.

For most of the past three years, Wall Street and investors have been captivated by the artificial intelligence (AI) revolution. Empowering software and systems with tools to make split-second decisions and allowing those systems to become more efficient at tasks over time, all without the need for human oversight, is a game changer. That’s why, in a report they called Sizing the Prize, PwC analysts project a global addressable AI market worth $15.7 trillion by 2030.

While the graphics processing unit (GPU) peak Nvidia has gained most of the fame in the AI space, arguably an AI data mining specialist Palantir Technologies (PLTR 1.37%) has ousted Wall Street’s largest publicly traded company as the hottest AI stock. Since the start of 2023, Palantir shares have rocketed 2,670% since the closing bell on November 7th.

Image source: Getty Images.

Outspoken Palantir CEO and co-founder Alex Karp deserves credit for successfully steering the ship. His company’s AI-driven software-as-a-service (Gotham) living platform is used by the US government and its allies to plan and oversee military operations, and there is no substitute.

But in the midst of this runaway success, Karp did one thing I’d argue a public CEO should never do: draw more attention to himself than to his company.

Palantir CEO Alex Karp focuses on short-sellers

Let me preface this discussion by pointing out that not all outspoken CEOs are inherently bad news for their company’s stock. thought Tesla CEO Elon Musk is no stranger to controversy, with his company’s stock nearing an all-time high.

However, the billionaire Palantir chief’s recent outburst in an interview with CNBC showed his clear feelings about short-sellers (investors betting on a decline in a public company’s stock price) and Scion Asset Management’s lead investor Michael Burry. Yesthis is the same Michael Burry, known as the “Big Short” investor, who successfully bet against the US housing market before the onset of the financial crisis, which generated a profit of around $725 million for his fund.

Today’s Change

(-1.37%$-2.65

Current price

$190.96

Key data points

Market capitalization

455 billion dollars

Daily range

$187.13 -$192.93

Range 52 weeks

$58.53 -$207.52

Volume

50 million

Avg. flight

63 million

Gross margin

80,81%

Dividend yield

ON

In response to a question from CNBC host Becky Quick about Michael Burry’s put option position in Palantir, which was disclosed on Nov. 3 via a Form 13F filing with the Securities and Exchange Commission (SEC), Karp made it clear, “I don’t like short-sellers,” and continued:

…If you’re a short-seller, you don’t really need to short a really great company. By the way, what’s great about Palantir is that we deliver for the average person on the battlefield, in the workplace, and as investors. Choose some other company to chat with.

But really in Burra’s case I think what was going on was market manipulation. I strongly suspect that he got out of his position; and to get out of his position he had to screw up the entire economy by tainting the best finance ever — again finance that helps the average person as investors and on the battlefield.

As an investor of 27 years, I learned a long time ago that when CEOs start complaining about short-sellers, that’s usually a big red flag for investors. While Palantir’s operating model and sustainable moat seem rock-solid, I think the basis of Karp’s claims about Burry and the short-sellers completely misses the mark.

Image source: Getty Images.

Karp’s rant is full of emotion and short on facts

Let’s start with the core of Karp’s open rant against short-sellers. Although everyone has a right to dislike short-sellers, it’s true really important to understand what this group of investors can and cannot do.

Short selling can be profitable, but it also comes with risks that don’t exist for investors who simply buy and sell stocks. Short sellers are betting that a public company’s stock price will move lower. while losses are limited to 100% of the principal investment and profits can be unlimited for those who buy shares of a public company, for short-sellers profits are limited to 100% (the company’s share price cannot fall below $0) and losses are theoretically unlimited.

In addition, short sellers pay interest (known as “margin”) to their broker when they borrow stock to bet against a public company. Depending on factors that include volatility and demand for shorting stocks, the interest rate on a bet against the stock price can be quite high.

What short sellers absolutely cannot do is directly impact the operations of a publicly traded company if managers carry on business as usual. Betting that a company’s share price will move up or down has no impact on its day-to-day operations, corporate governance, marketing, ability to innovate, competitive pressures, and so on. To say that short sellers will “mess with Palantir,” as Karp made clear in his CNBC interview, ignores this basic fact. It’s like blaming the small section of fans who booed in the stands that your sports team lost a game instead of directing any responsibility to the players who were actually on the field.

Additionally, Karp’s claim that Michael Burry of Scion Asset Management manipulated the markets with his put option trade against Palantir lacks evidence. Like all institutional investors that manage at least $100 million in assets, Scion is required to file a quarterly 13F with the SEC. Burry’s fund is in full compliance with this measure and there is no public information to suggest that it is attempting to manipulate Palantir stock.

Palantir’s bigger problem is its historically ugly valuation.

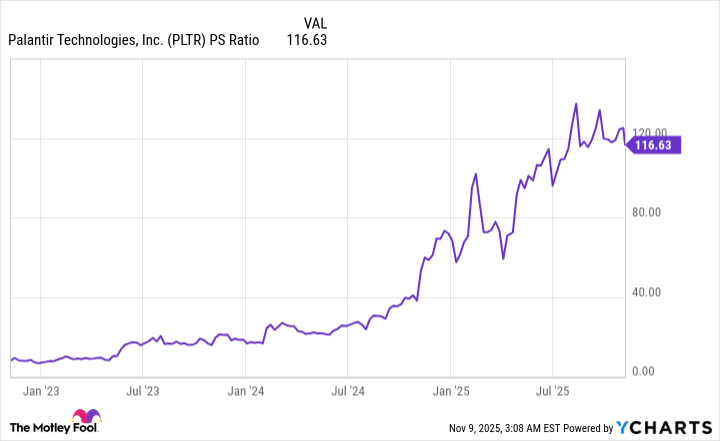

PLTR PS ratio data by YCharts.

History tells us that large-cap companies leading cutting-edge innovation have consistently peaked at price-to-sales (P/S) ratios of around 30 to 40 over three decades. Prior to the release of operating results after the closing bell on November 3rd, Palantir was trading at a trailing 12 month P/S ratio of 152!

To put this into context, no company has ever been able to maintain a P/S ratio above 30 for any length of time. Even with year-over-year revenue growth pushing 40%, Palantir’s P/S ratio was five times higher than last week. That’s likely why some short sellers expect Palantir stock to fall. Sometimes the business makes sense, but the valuation doesn’t.

If Alex Karp is wise, he’ll let his company’s operating results do the talking because that’s the best way to combat short-sellers.