Dividend-paying stock will join Berkshire Hathaway in the $1 Trillion club ahead of Walmart

The $1 trillion club is growing thanks to record earnings and investor enthusiasm.

The stock market has seen many market capitalization milestones in recent times. Nvidia exceeded $5 trillion in market capitalization and Microsoft and Apple climbed above $4 trillion.

At this writing, Alphabet is more than $3.3 trillion, Amazon is around $2.6 trillion and Broadcom, Platform metaand Tesla they are all over $1.4 trillion.

But the only US non-tech company with a market cap above $1 trillion is Berkshire Hathaway (BRK.A +0.17%) (BRK.B +0.02%).

Here’s why JPMorgan Chase (JPM 0.40%) could become the next value stock to join the $1 trillion club, and why a dividend stock is buying now.

Image source: Getty Images.

Two financial titans

Warren Buffett’s Berkshire Hathaway is getting a lot of attention for its positions in public stocks. But the value of its controlled insurance-led businesses, as well as its pile of cash, cash equivalents and treasury bills, is far more valuable.

Berkshire’s strength lies in its ability to produce growing operating profits from the businesses it controls, reducing the pressure on the need to buy shares in public companies. In fact, Berkshire is reducing its holdings in top holdings such as Apple and Bank of America (BAC +0.39%) and has gone five consecutive quarters without repurchasing Berkshire Hathaway stock.

JPMorgan is similar to Berkshire in that it is a highly differentiated business that can pull multiple levers to grow earnings. The diversified bank generates income from its commercial and investment banking services as well as net interest income (NII) from interest-bearing assets. When interest rates are high, a company can generate more net interest income, but high rates can also slow down deals, mergers and acquisitions, and mortgage and auto loans.

NII is the difference between interest earned on loans and interest paid on deposits. It is similar to an insurance company, which is the amount of premium that has not been paid out in claims. For decades, Warren Buffett has discussed the importance of growing a Berkshire float. The stock is now so large that Berkshire generates trillions in revenue from it every quarter. NII is valuable because it is highly profitable and has a high margin.

The other side of the business is the non-interest income that JPMorgan generates from fees, commissions, investment banking and asset management services.

As shown in the table, JPMorgan has continuously increased its net interest income and non-interest income (virtually uninterrupted) over the past decade.

| Metric | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 (instructions) |

|---|---|---|---|---|---|---|---|---|---|---|

| Net interest income (trillions) | $46.08 | $50.1 | $55.05 | $55.06 | $54.56 | $52.31 | $66.71 | $89.27 | $92.58 | 95 dollars |

| Non-interest income (in billions) | $49.59 | $50.61 | $53.97 | $53.72 | $64.98 | $69.34 | $61.99 | $68.84 | $84.97 | ON |

Data source: JPMorgan Chase.

Over the past three years, results have accelerated in line with JPMorgan’s rising share price — which has tripled over the past five years. The financial sector has more than doubled and outperformed during this period S&P 500 (^GSPC +0.21%).

Today’s Change

(-0.40%$-1.27

Current price

$315.62

Key data points

Market capitalization

859 billion dollars

Daily range

$315.28 -$319.05

Range 52 weeks

$202.16 -$319.56

Volume

5 million

Avg. flight

7.9 million

Gross margin

0.00%

Dividend yield

0.02%

Increased rating

JPMorgan’s outsized earnings are underpinned by quarter after quarter of breakout results. In the third quarter of 2025, JPMorgan earned a whopping 20% return on tangible common equity (ROTCE). ROTCE is a key profitability metric used by large banks to show how efficiently they are leveraging their capital. This is similar to how investors compare operating margin as a metric of profitability in other industries.

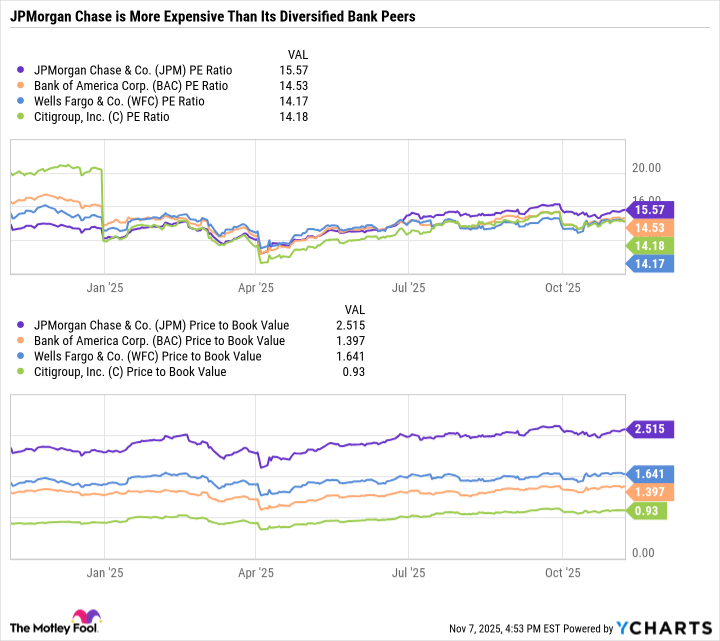

JPMorgan’s ROTCE tends to be higher than its peers – Bank of America, Wells Fargo (WFC +0.10%)and Citigroup (C 0.72%). This is why JPMorgan has a more expensive valuation on a price-to-earnings (P/E) and price-to-book (P/B) basis.

JPM PE ratio data by YCharts

For context, JPMorgan’s 10-year median P/E is 11.9 and its 10-year median P/B is just 1.5. So the bank is currently relatively expensive, but for good reason, as its growth rate has accelerated.

Like JPMorgan, Walmart‘with (WMT +1.00%) the share price has skyrocketed in recent years. Both companies now have market capitalizations of over $800 billion, pushing them closer to joining the $1 trillion club.

Like JPMorgan, Walmart’s stock price is responding to improving fundamentals of the underlying business. The company has done a masterful job of delivering value to its customers and delivering solid results, despite many of its retail and consumer goods peers struggling. In the most recent quarter, Walmart’s sales rose 4.8% year-over-year, but adjusted operating income rose less than 1%.

Walmart is using artificial intelligence (AI) to improve its operations – announcing a partnership with OpenAI that allows customers to complete purchases from Walmart directly in ChatGPT. Walmart is getting great results from its advertising business as well as e-commerce and delivery through Walmart+. But still, those results aren’t good enough to justify its sky-high P/E of 38.7 compared to the 10-year median P/E of 28.4.

A stock at a premium price worth buying now

Buying stocks at all-time highs is never easy. But in today’s market, it’s hard to find high-quality, top-notch companies at very cheap valuations.

The solution is not to sell off the expensive market, but rather to focus your portfolio around companies that can consistently grow earnings fast enough to justify their valuations.

JPMorgan stands out as the most likely candidate to join Berkshire Hathaway in the $1 trillion club simply by continuing to grow its net interest rate over time. Meanwhile, Walmart is already expensive and has no clear path to accelerating earnings growth at a rate that would justify its already inflated valuation.

JPMorgan and Walmart both return significant amounts of capital to shareholders through buybacks and dividends, but JPMorgan has a higher yield of 1.9% compared to Walmart’s 0.9%.

All in all, JPMorgan stands out as the type of expensive stock worth buying and holding, while Walmart isn’t growing earnings fast enough to justify its nosebleed valuation.