(Credits: Adobe Stock)

And if the housing crisis illustrated the exhaustion of an alternative to the owner or tenant. There are new offers and multiply the possibility of ownership of the house.

The housing crisis emphasizes tensions between economic and social dynamics. Very necessary, housing becomes a factor of growing inequalities. The increase in interest rates between mid 2022 and early 2024 made it difficult to own the house for many French households.

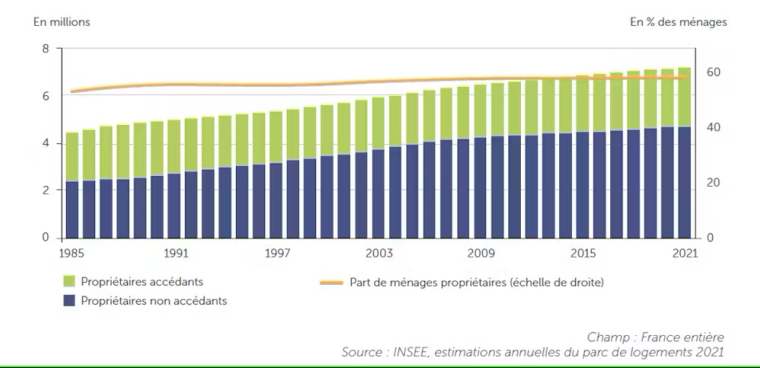

In 1980, France had 50 % of the owners. At present, the share reaches 58 % (see graph) is deep below the European average of 70 %. England and the United States are 65 %. With the saturated rental market and 2.5 million applications waiting for the social sector, generation, social and territorial fractures are expanding.

Source: Insee, annual park estimates 2021

New models

To respond to this situation, there are different ways to facilitate access to property. Public and private initiatives increase between innovations and updates of old solutions. However, this complex offer may lose an individual that faces heavy and emotionally charged decisions.

This article decrypts new available solutions, analyzes their design design and examines the basic mechanisms of their business models.

The distribution of assets is to divide the assets into two. On the one hand, bare ownership (or the right to assets, that is, it can sell or transmit a property, but cannot use it or perceive its fruit as rent) and usufruct (the right to use the property and perceive income). This mechanism, which is used for investment and transfer of inheritance, allows the bare owner to obtain a property at a lower cost, while the USufruck draws revenue or temporary use with tax advantages for both parties.

As part of the purchase of real estate, this device allows individuals to obtain bare ownership at a reduced price, while another actor (often landlord) holds a USUFRUKT for a defined period of time. During this period he perceives the USUFUra rent or occupies the property free of charge for the bare owner. At the end of the division, the other is recovering a full property, often awarded. Ideal for the preparation of future residence or investing with better profitability eliminates the restriction of lease management.

Reduced Cost of Access to Real Estate

Another composition of innovation is the dissociation of Land-Bâti, which separates property from land from the property of accommodation. In this context, the buyer becomes the owner of the building, while the soil belongs to a public, private or associative entity for a modest fee. This model makes it possible to reduce the cost of accessing real estate by exclusion of often very expensive land in urban areas and limits speculation with real estate supervision to further sale of accommodation by provisions enrolled in rent. Current in the UK, this solution in France is accepted by the organizations of Land Organization (OFS) through the actual rental of Solidarity (BRS), which guarantees a permanent offer of affordable housing.

A remarkable example is the property of the city of Paris, created to facilitate access to property of medium -revenue households. La Foncière retains land assets, while accommodation is sold under the BRS regime, allowing the buyer to become a building owner at controlled prices, approximately 5,000 euros/m2, half the price of the Paris market. The buyer pays the license fees for the occupation of the field and reduces the total costs and maintains the affordability in the long term.

The joint investment in the housing sector is based on a simple principle: several players combine their resources to finance real estate projects. These actors may include public institutions, private investors, businesses or individuals. By associating funds and skills, this model allows you to share risks and carry out projects often inaccessible individually, such as the construction of social housing, students’ residence or city renovation programs. Partnership of the public and private sector illustrates this approach well and combines public and private resources to create affordable housing.

Personalized support

In connection with the growing needs of housing, some players adapt to the joint investment and selling housing for individuals. For example, Virgil helps young workers to gain access to ownership without a significant personal contribution. The company funds up to 25 % of the purchase price without requiring rent or monthly payments in this section, thereby maintaining the borrowing capacity of the buyers. In addition, it offers personalized support: budget evaluation, assistance with loan negotiations and administrative formalities. This global support simplifies the real estate course and strengthens the trust of the first buyers. Virgil is rewarded by renewing its re -evaluation in further sale or redemption of shares, as well as annual compensation of 1 % to the 10 % invested industry. His “Asset Light” model limits immobilized capital and diversifies projects.

In the face of the outbreak of real estate prices and the low attraction of investment investment, the classic model “use against rent” shows and creates insufficiency between the value of use and the exchange value. A hybrid model is inspired by an automobile leasing, combining a partial property, a solid royal rank for twenty -five years and safety of use. This system wants to offer an accessible and flexible alternative, satisfying household needs and at the same time ensuring attractive financial conditions for investors.

Flexipropeaes allows a gradual access to the property. The buyer can buy the initial part of the property, for example 20 %, with full use of housing. The rest is held by the investor (social landlord, promoter or bank) and the buyer pays the fee for not being obsessed. Then he can gradually buy additional shares according to his financial capacity until he reaches full ownership.

Initial limited contribution

This system has several advantages: it reduces the initial amount necessary to become the owner, allows you to occupy accommodation as soon as the first shares are purchased and offers an increase in real estate adapted to the household resources. For example, Neoproprio offers a model in which the buyer funds 50 % of the price of the property and signs an emptytetic rent for 25 years by paying a reduced annual fee. It occupies accommodation as the owner and at the same time limits the initial contribution and monthly payments. At the end of 25.

Through this system, the company is remunerated by the annual fee paid by the buyer (1.2 % of the value of the property) and the share of capital profit in the case of early sale. The model is also based on a margin made during the purchase and management of goods through partnerships. This mixture of financial innovation and personalized support offers solutions that are profitable and adapted to the needs of households.

Brake persistence

Several reasons explain that these models of alternative acquisitions are less recognized than conventional real estate purchase. First, they are often perceived as complicated because of the legal and financial arrangements that include, which can be discouraged by the individual. Moreover, the lack of knowledge and understanding of these devices and third -party addiction introduces other uncertainties. Finally, these models are often perceived as risky or less safely than classic purchase, especially when it comes to further sale and valuation of real estate.

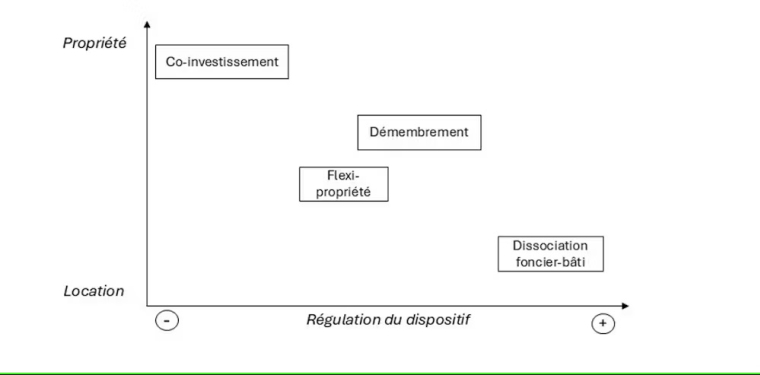

In synthesis, we map these models of house ownership according to two key dimensions for individuals who want to get accommodation: on the one hand the level of property property, which is located between rent and full ownership; On the other hand, the level of regulation performed by public authorities on these facilities.

This article was written with Sylvain Bogeat, President of Metropolises 50.

This article comes from the conversation site

(Tagstotranslate) Paris Bourse