Nvidia name-checks Michael Burry in secret memo pushing back on AI bubble accusations

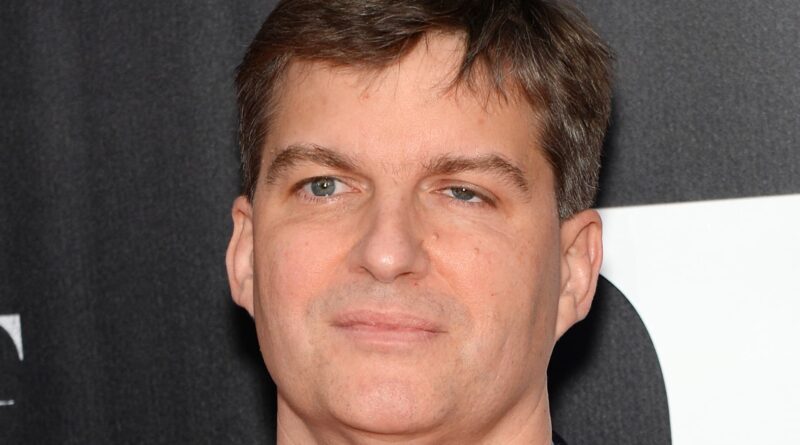

The fight between Nvidia and one of his most vocal detractors, investor Michael Burry, is escalating.

Following a series of social media posts by a “Big Short” investor claiming that the AI investment boom was replaying the dotcom bubble of the 1990s, with Nvidia at its center, the chipmaker quietly sent out a private message to analysts who specifically ticked off Burry’s name to refute many of his claims.

Nvidia’s seven-page response to “questions and claims we have received” began by citing “Michael Burry on Twitter / X” as the first collection of source documents the company sought to refute.

For his part, Burry responded in a post on Substack that: “Nvidia emailed Wall Street sell-side analysts to reject my arguments about (stock-based compensation) and write-downs…I stand by my analysis. I’m not saying Nvidia is Enron.” Cisco.”

Burry has repeatedly warned that today’s AI infrastructure frenzy mirrors the telecom build-out of the late 1990s far more than investors remember from the dot-com wipeout. He pointed to massive investment plans, extended depreciation schedules and soaring valuations as evidence that markets are once again mistaking booming supply for sustainable demand.

Nvidia’s memo, first reported by Barron’s, responded to Burry’s criticism of diluting Nvidia’s stock-based compensation and share buybacks.

“NVIDIA has repurchased $91 billion of stock since 2018, not $112.5 billion; it appears that Mr. Burry incorrectly included tax RSUs,” the memo said, referring to the restricted stock units. “Employee equity grants should not be confused with the performance of a buyback program. NVIDIA employee compensation is consistent with peer compensation. Employees benefiting from a rising stock price do not indicate that the original equity grants were excessive at the time of issuance.”

The communication also disputed Burry’s claim regarding the useful life of the depreciation. To Burry’s allegation that customers overestimate the lifespan of Nvidia GPUs to justify inadvertent capital expenditures, Nvidia counters that its customers depreciate GPUs over four to six years based on actual lifespan and usage patterns.

Nvidia added that older GPUs, such as the A100s released in 2020, continue to run at high utilization rates and maintain meaningful economic value even after two to three years, as critics say.

The memo also rejects Burry’s “circular funding” proposal, saying that Nvidia’s strategic investments represent a small fraction of revenue and that AI startups raise capital mostly from outside investors.

Today’s Cisco

Burry said he believes Nvidia is now in the same position that Cisco — the key hardware vendor that drove the massive capital investment cycle — was in 1999-2000.

Just as telecommunications companies spent tens of billions of dollars laying fiber optic cables and buying Cisco equipment based on predictions that “Internet traffic will double every 100 days,” today’s hyperscalers are promising nearly $3 trillion in AI infrastructure spending over the next three years, Burry said in the Substack newsletter.

At the heart of his Cisco analogy is an oversupply that meets far less demand than expected. In the early 2000s, less than 5% U.S. fiber capacity was operational, Burry said. Today, he believes the industry’s belief in limitless demand for AI rests on similarly optimistic assumptions about data center performance and GPU lifespan, he said.

“And again, at the center of it all is Cisco with picks and shovels for everyone and a grand vision to go with it. It’s called Nvidia,” Burry wrote.

— CNBC’s Michael Bloom contributed reporting.